What’s Next for Community Development Finance?

NonProfit Quarterly

DECEMBER 11, 2024

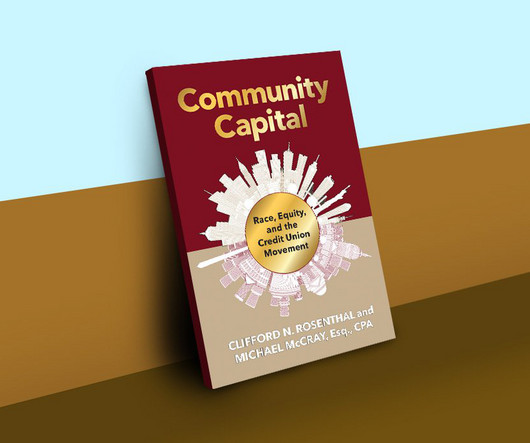

How the CDFI Sector Came to Be: A Legislative History Community development finance is arguably as old as finance itselfafter all, the purpose of finance writ large is supposed to be community reinvestment. Rosenthal noted that timing was critical in moving the CDFI Fund from policy idea into law. Advocates won big here.

Let's personalize your content