From Microfinance to Mutual Aid—Moving Resources to People, Not Banks

NonProfit Quarterly

MARCH 12, 2025

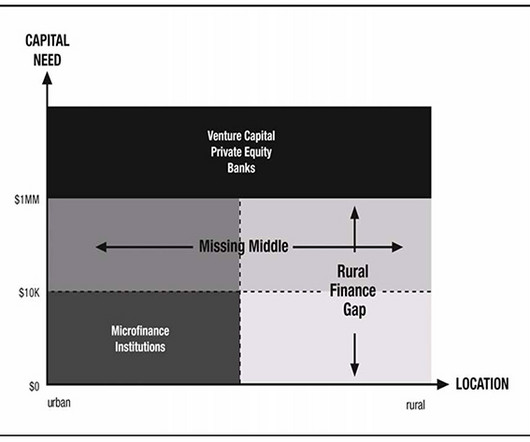

In the 1970s, economist Muhammad Yunus pioneered the concept of microloans through the Grameen Bank in Bangladesh, a revolutionary idea that aimed to lift people out of poverty by offering small loans to those excluded from traditional banking. Yunuss premise was simple: People know better.

Let's personalize your content