Senators Push to Restore the Universal Charitable Deduction: 3 Things You Need to Know

NonProfit PRO

MARCH 8, 2023

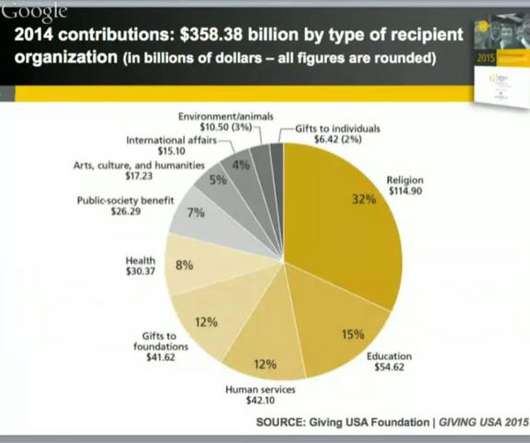

Last week, senators introduced legislation to make the universal charitable deduction effective for tax years 2023 and 2024. Now dubbed “Charitable Act,” the legislation, if passed, would give more Americans the ability to claim tax deductions for charitable contributions.

Let's personalize your content