How to Restore Community Economies: Reestablishing the Right to Associate

NonProfit Quarterly

NOVEMBER 13, 2024

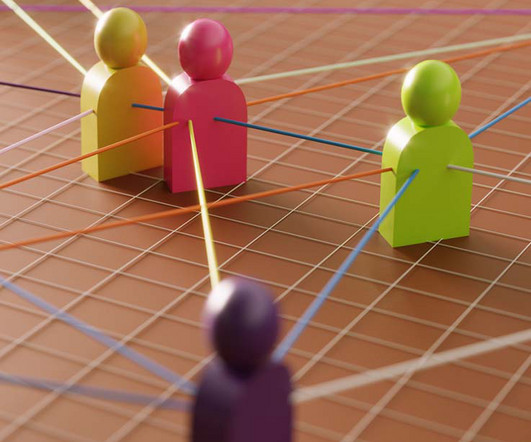

Decades of policy changes, however, often under the radar, today inhibit many diverse kinds of association. [We We need] the means to build associations that are powerful enough to successfully challenge the economic powers that be. Mutualism is the right to associate let loose in the economy. This must be rectified.

Let's personalize your content