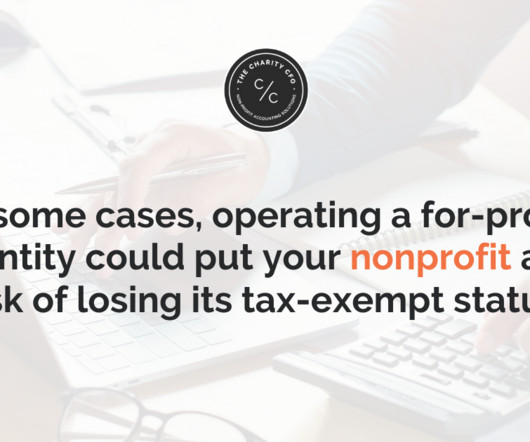

Corporate Partnerships & The Law: Contracts ??

Selfish Giving

FEBRUARY 29, 2020

requested guidance on in the Selfish Giving / Accelerist Partnership Law Survey you completed last spring. Corporate Partnerships & The Law: Contracts 1. Companies may want the charity partner to undertake specific activities. State Law Required Provisions. SellCo sent us a draft contract to sign.

Let's personalize your content